The high inflation and dramatic increase in interest rates coupled with weaker economic growth has seen most major asset classes, such as bonds, equities and property, fall in value since the start of 2022. To put the market moves of the last year into context, simultaneous annual losses for equities and bonds are very unusual; since 1926, this has only occurred three times.

It is unsurprising therefore that one of the questions we have been asked recently by clients is “Why should I invest?”. The short answer is because equities and bonds deliver superior returns to cash over the longer term; but this does require a certain amount of patience. Whilst returns from equities and bonds are uncertain over the short term, we expect them to deliver strong returns over the medium and long-term, and particularly from a starting point like we have today. By contrast, cash may pay a definite and relatively high return in the near-term, but today’s high interest rates could drop in 12 months.

Therefore, why invest now? Inflation has receded, meaning the Federal Reserve, Bank of England and other major central banks are closer to the end of their tightening cycles. The employment market has cooled, but not so much as to push the economy into a recession. Earnings have improved, with US-listed company profit expectations now back at all-time highs. Yet global equities are little changed, and bond yields remain elevated.

In our view, this creates an opportune moment for investors. Against a supportive backdrop for equities and with bond yields high, we expect attractive returns across these asset classes. Cash offers good current yields, but we expect bond and equity returns to prove durable.

There are always risks to this view on the horizon with inflation still above official targets. It is unclear if or when the interest rate hikes that central banks have enacted will begin to have a larger effect. However, let us look further at these asset classes…

Equities

One of the best long-term investment strategies is to buy cheap and sell expensive. Sounds simple, doesn’t it? But you would be amazed how often that goes out the window when there’s a “fear of missing out” and investors are increasingly taking a shorter-term view. The long-term return from equity markets has been 8% p.a. and this has been achieved after wars, periods of low/high inflation, recessions, changes in governments, bubbles, pandemics, etc. The long-term return from companies is derived from earnings growth and companies on the whole have a good track record of increasing revenue and profits above that of inflation.

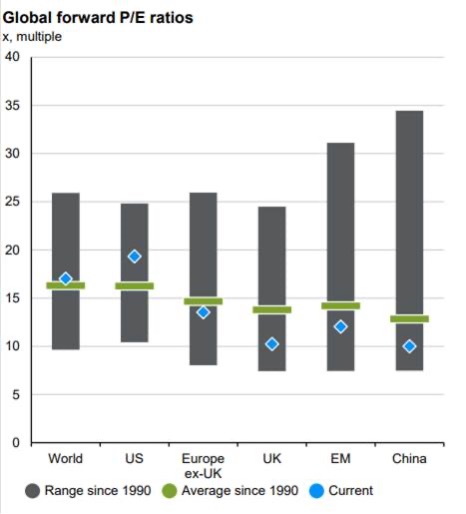

It is important to be selective. Not all stock markets are created equal, and markets have particular biases e.g. the US to Technology. We are finding selective areas of the market are cheap and believe buying at these levels and holding over a medium to long-term perspective can deliver returns in excess of the usual 8% annualised equity returns mentioned above. Equity markets move ahead of the economy and in some areas have priced in a recession that might not be coming.

Global forward P/E ratios

x, multiple

Data source for chart: IBES, LSEG Datastream, MSCI, S&P Global, J.P. Morgan Asset Management. Forward P/E ratio is price to 12-month forward earnings. MSCI indices are used for all regions/countries (due to data availability), except for the US, which is represented by the S&P 500. Range and average for China is since 1996, due to data availability. Past performance is not a reliable indicator of current and future results.

Bonds

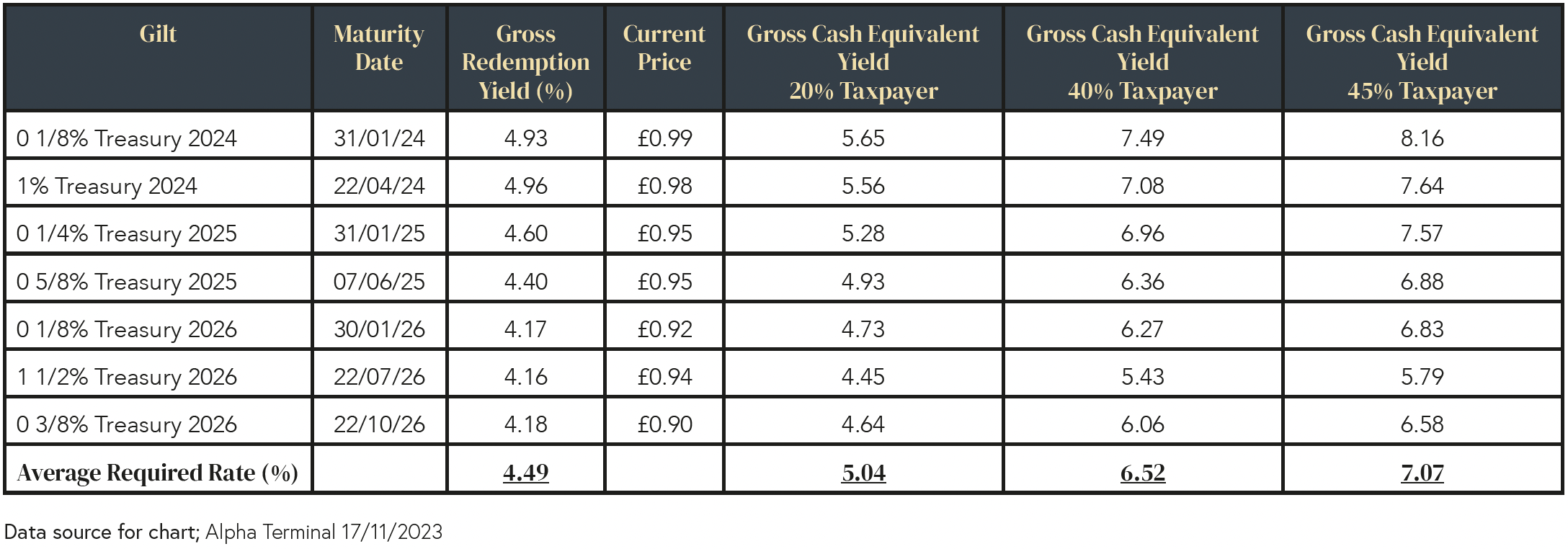

The below table focuses on shorter dated UK government bonds which were all issued at 100p and will mature at 100p on their respective maturity dates. There are several advantages to buying government bonds, but one is that any recovery in price for individuals is tax free.

The gross redemption yield (GRY) combines both the low coupon and recovery in price to 100p. Most of the return going forward is going to be tax free for individuals because the recovery in price to par value is Capital Gains Tax exempt. Tax is still payable on any interest received, this makes the GRY extremely attractive, particularly for higher and additional rate taxpayers.

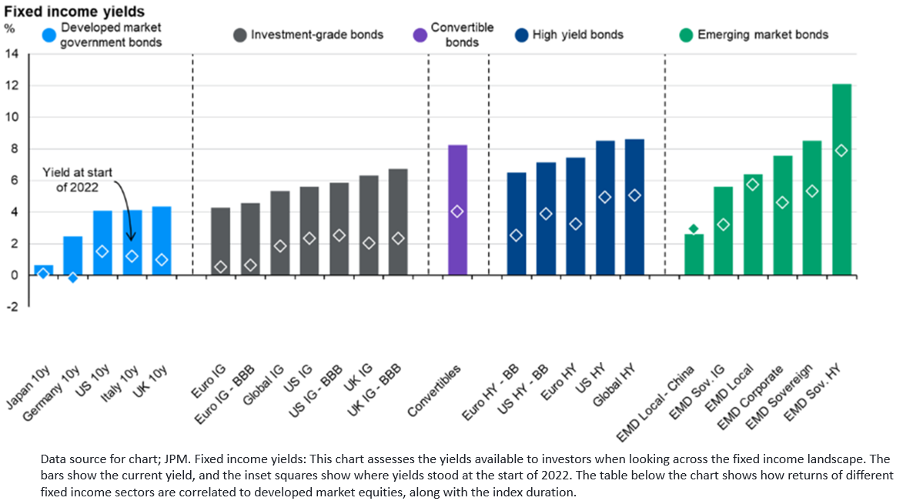

It is not just shorter dated government bonds which are attractive, all fixed income markets are priced in relation to government bonds and as the GRY has increased on government bonds that has had a knock on impact to corporate, high yield and emerging market bonds. The Fixed Income Yields chart overleaf shows the current yield on offer from the assets (the bar chart) and compares it to the yield on offer at the beginning of 2022 (the diamond). As you can see, across the board bond yields are higher today and it is now possible to get 7-10% annual returns on these bonds. As equity markets over the long term have delivered 8% returns it means investors have the potential of ‘equity like’ returns from bonds.

Fixed Income Yields

We believe the market volatility of the last two years is in the rear-view mirror and are confident that a diversified portfolio of investments will provide greater cumulative returns than that earned on cash over the coming years. Investors who are able to take a medium to longer term view should maintain equity and bond exposure, and also add to their holdings if they have available capital. The returns on cash deposits have undoubtedly improved from the levels we have seen in the recent past, but they are still below current inflation rates. Equity and bond markets continue to provide greater ‘real’ returns over a longer time horizon.

As ever, if you have any questions please get in touch on 0161 518 3500 or email a member of the team.

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.