High-Interest Bank Accounts vs Gilts

In today’s economic climate, it feels more important than ever to put your money to work. But what does this look like in a world buffeted by fluctuating markets, rocked by global instability and crushed by inflationary pressures?

It might seem tempting to throw your money into a high-interest, high street bank account and call it a day. After all, with some savings accounts currently offering up to a whopping 6% – coupled with the simplicity of opening and managing one of these accounts – some are tempted to ask: Why would I look elsewhere?

Recent years have been defined by rock-bottom interest rates, so investors can be forgiven for having gone off the idea of growing their money by putting it in a bank account. But the situation has been flipped on its head, and now central banks have hiked interest rates across Europe and America. In this climate, cash is certainly having a comeback, and investors are taking up high-interest banking offers as a way to make a quick and guaranteed return.

But while having cash is one thing, knowing how best to grow it is another. So is there a better alternative to the high-interest savings accounts on offer right now?

The high-interest savings account comeback

Banks have historically been slow in passing on interest rate hikes to customers – with savers and those with extra cash losing out the most. Now, however, high street banks are finally catching up and aligning their offerings with the much higher interest rate set centrally by the Bank of England. This means inflation-busting interest rates for savers, coupled with low (or no) fees and the lure of easy access. We can see why this offering is hard to resist – especially when you consider that most investment accounts hover around a 2% interest rate and top cash ISAs struggle to break the 4% ceiling.

But there’s a catch. If you’re a higher or additional rate taxpayer, take note. Return on cash might seem like a no-brainer at 6%, but once taxed at your marginal tax rate, you might be left feeling short-changed.

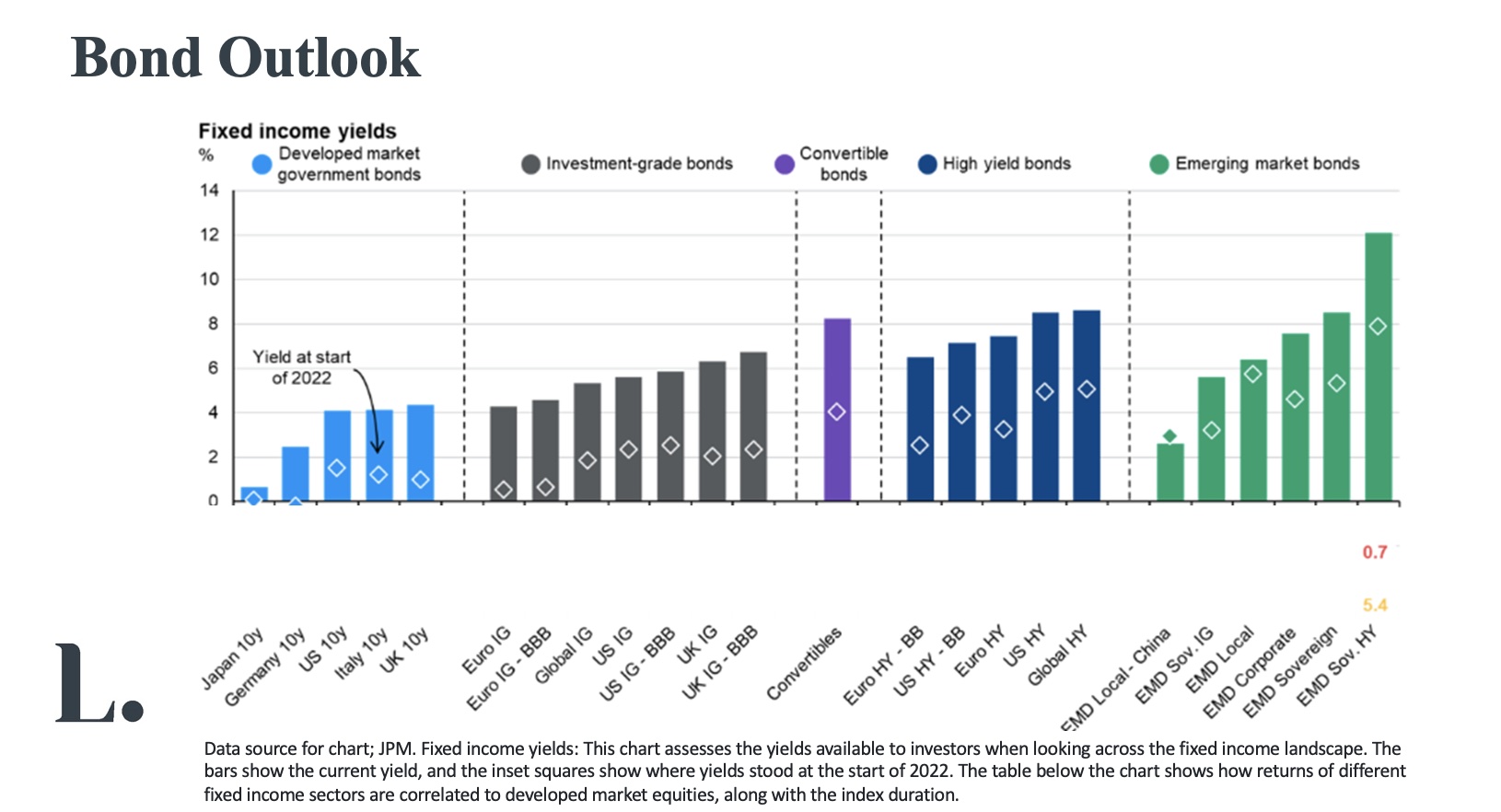

Consider, too, that an increased return on cash usually means better returns across the board. Bonds, shares, you name it… while nothing is guaranteed, we’ve seen in the past that when cash rates rise, the rest of the investment landscape also tends to improve. This makes it more important than ever to consider all the available options.

Introducing gilts

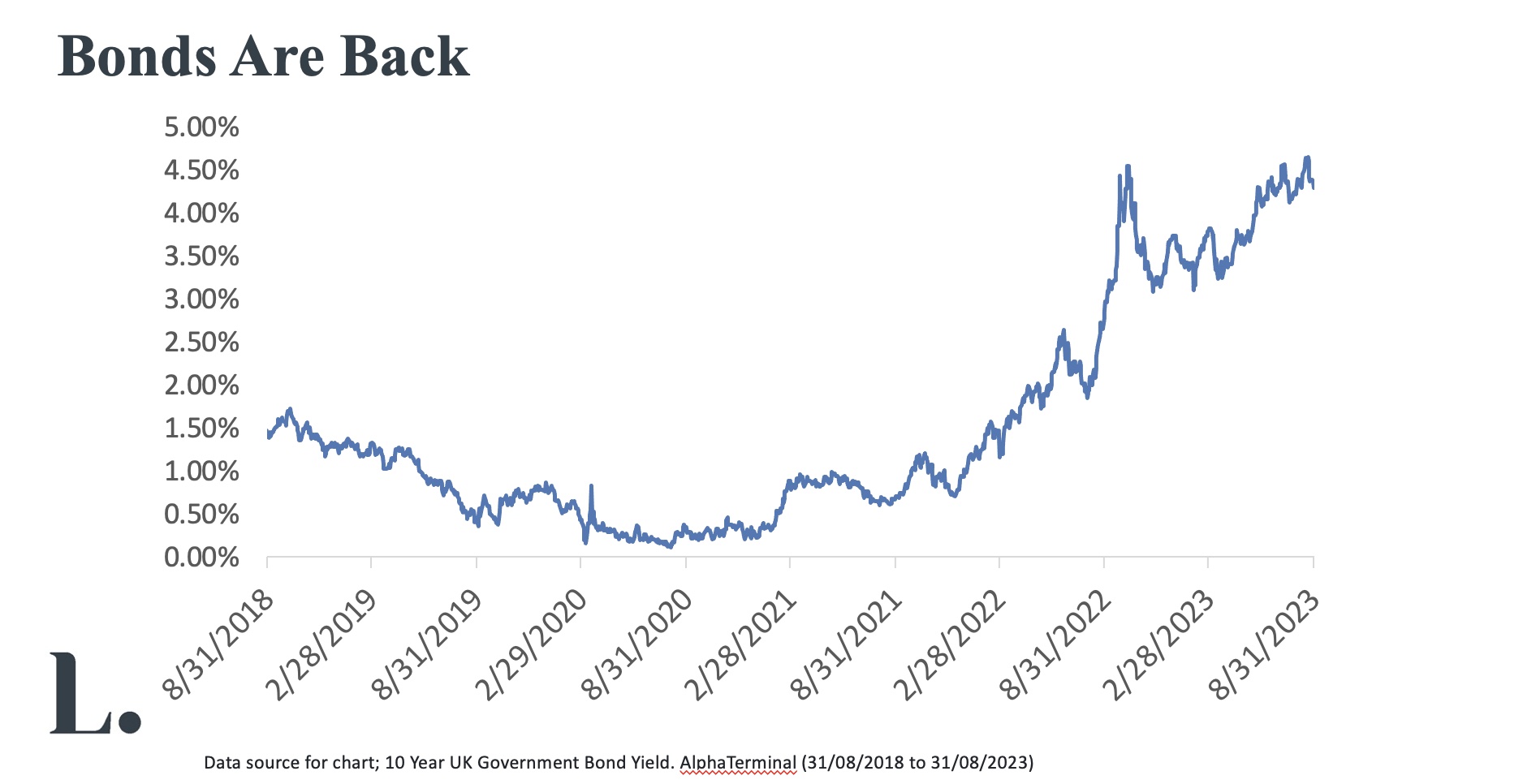

UK Government bonds, or gilts, are a prominent form of investment in the UK financial market. Recently, demand for gilts has soared.

Gilts are loans made by investors to the government, enabling it to raise funds for various public projects. When you invest in gilts, you’re essentially lending money to the government in exchange for a promise to receive regular interest payments and the return of the principal amount after a fixed amount of time. This is the point at which the gilt is said to ‘mature’.

A key aspect of gilts that enhances their appeal to many investors is their high level of security. Gilts age like fine wine, so if you hold on to a gilt until its maturity date, the risk of losing your investment is extremely low at current market levels. This is because the repayment of gilts is backed by the government, which is extremely unlikely to not repay debt on its obligations. In the rare event that a default occurs, it would imply a scenario where the government is in significant financial distress.

Let’s delve deeper.

With 10-year UK Gilts currently yielding around 4.5%, they might seem less attractive compared to a 6% savings account. But remember, savings rates are transient. In a couple of years – or maybe even sooner – interest rates could come at least some of the way back down to Earth. In such a scenario, the steady return from a gilt held to maturity might outweigh the fleeting gains of a high-interest savings account.

Gilts also come with tax perks. While interest – the coupon – paid by a gilt every six months is taxed as income, you’ll pay no tax on any capital gains. This means that, if you decide to sell a gilt or at maturity at a profit , you will not pay Capital Gains Tax (CGT). Today’s investors should remember that since most gilts are trading below their maturing value, a capital gain from this point – if held to maturity – is guaranteed.

Some investors are understandably wary of the potential tax burden that their coupon payments may incur. Let’s put this into context. Because most gilts were launched when interest rates were low, their small coupon values come with far fewer tax implications. So, in many cases, the returns from capital gains here, when held to maturity, outweigh the taxes on coupon payments.

Of course, if you choose to wrap your gilts within a tax-efficient product like an Individual Savings Account (ISA) or a Self-Invested Personal Pension (SIPP), no UK income tax will be applicable.

What next?

With interest rates at, if not reaching, their peak, bonds, especially gilts, are attractive investment options. In the longer term, their combined tax benefit advantages and longer-term stability could outweigh many easy-access bank accounts.

Whether you currently prefer investing in equities or the higher, albeit fluctuating, steady return from savings accounts, diversifying with gilts is a move which many high-net-worth individuals should consider in challenging economic times. Either way, working with a wealth manager will help you weigh up your options and, if you decide they’re right for you, get you started on your gilt-buying journey.

Remember, as always, that it’s crucial to stay informed, stay diversified, and stay invested in your financial well-being.

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396