Inflation has now started falling

during the last quarter

The main talking point during the quarter continues to be the stickier inflation we are feeling in the UK. The good news is that inflation has now started falling during the last quarter; in March the Consumer Price Index (CPI) was 10.4% whilst in April it had fallen to 8.7%. The bad news is that inflation is not falling as fast as expected and the Bank of England (BoE) would have hoped. With the economy flatlining and delivering a 0.1% growth rate in the last quarter, the BoE seem intent on fighting inflation and in June decided a bigger adjustment was required with a 0.5% increase, taking interest rates to 5%; the highest rate in 15 years.

Looking forward, inflation is expected to continue to moderate with September’s energy tariff cap rolling out of the annual equation. In other areas, such as food, prices are still increasing which is keeping inflation a lot higher and stickier than had been expected. There is also a view that companies are using ‘inflation’ as an excuse to restore their profit margins. Regardless, we continue to believe we are close to the end of this interest rate cycle. This is because of the vast amount of debt held by governments and households. In the coming months and years, the cost of servicing that debt will become higher, which will ultimately weigh on economic growth.

Whilst the BoE continue to increase interest rates, just as importantly (if not more so) from an investment perspective, the US Federal Reserve have now paused. This pause, following 10 straight increases, might only be for a few months but this respite has been welcomed by markets.

Another main topic of conversation in recent months has been Artificial Intelligence (AI). We are believers in the efficiency that this development can bring to individuals and companies over the coming years, however we are still in the foothills and unable to quantify the impact at this point. As can be the case from time to time though, market exuberance has come to the fore. That has certainly been the case in 2023, with several US technology related businesses exposed to AI seeing significant gains in their share prices. In our view it is too early to say who are going to be the long-term structural winners from this but we believe there will be a number.

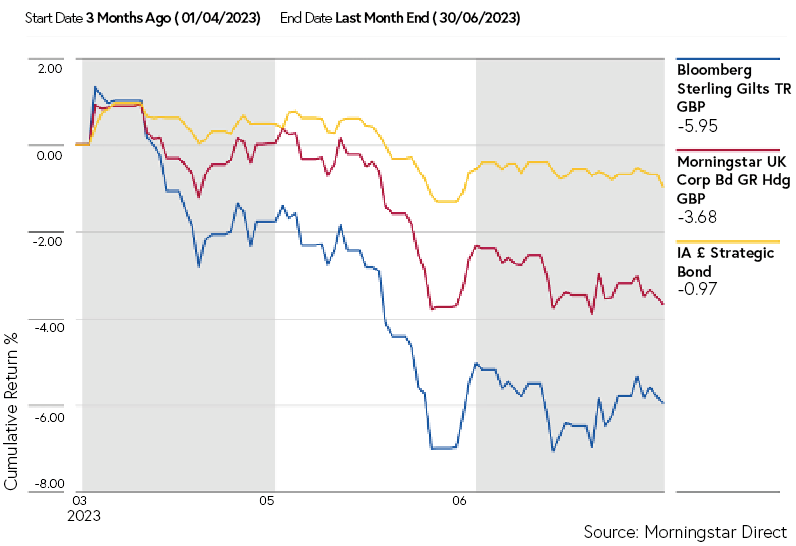

This backdrop of higher inflation and AI excitement has been the key influence on markets. As witnessed by the performance in 2022, safe haven government and corporate bonds have fallen in value because of the inflationary and higher interest rate backdrop. Bonds deliver negative returns when inflation is high and interest rates are increasing, although they now appear good value if interest rates are soon to peak.

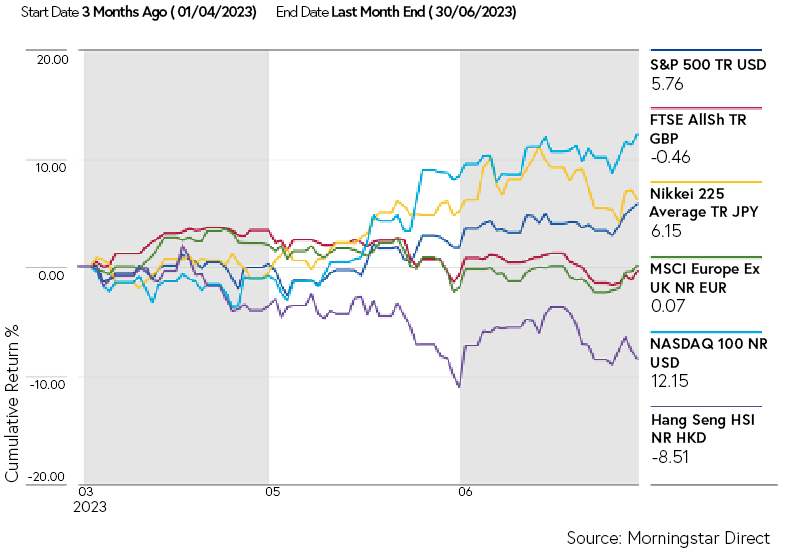

From an equity investment perspective, the performance has been mixed across the regions. The US and Japan led the way by delivering strong returns, the former being helped by the number of US companies linked to AI. The UK and European markets have delivered flat returns in the quarter. China has had more of a torrid time as the initial euphoria of the economy reopening has waned and economic growth is not bouncing back as strongly as most had expected.

In summary, having risen from the lows of September 2022, a diversified portfolio has been rather muted over the last quarter. Equity markets appear to be in ‘watch and wait’ mode, hopeful that the key US inflation will continue to fall and interest rates will therefore peak but remain mindful of the possible downside risk to economies following the increases we have already experienced. Whilst this scenario is likely to remain over the summer months, the increase in the base rate does mean portfolios can benefit from the returns now available in cash and UK government bonds.

As ever, if you have any questions please get in touch on 0161 518 3500 or email a member of the team.

Global Equity Markets in Q2

UK Bond Markets in Q2

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.