Tough quarter for AIM companies with the

majority of share prices falling in value.

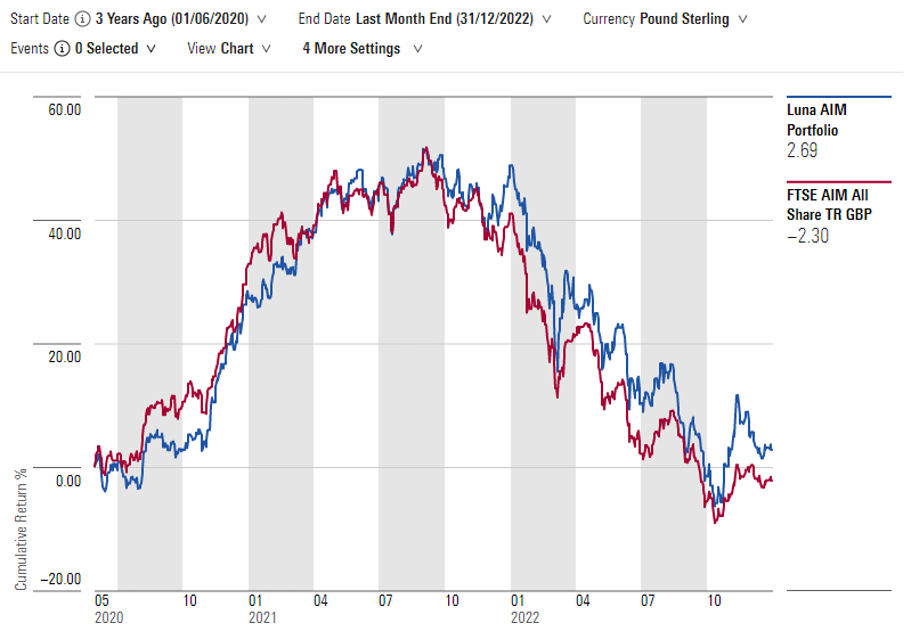

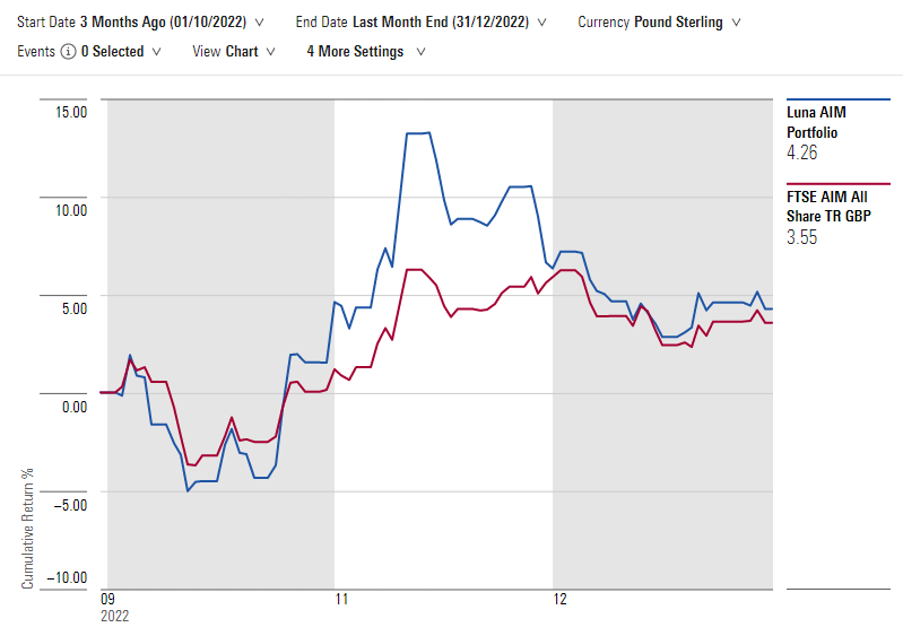

The Luna AIM portfolio delivered a return of -5.3%* during the second quarter which was slightly ahead of the FTSE AIM All Share TR index of -6.3%*. We are conscious that this is a very short-term time period and when taking a slightly longer-term perspective from launch (01/06/2020 to 30/06/2023) the Luna AIM Portfolio has outperformed, returning 1.65%* compared with the FTSE AIM All Share TR of -10.51%*.

During the quarter the standout positive performer was Volex, which surged 31%**. This was on the back of a strong trading update which highlights a strong performance to end March 2023, with revenue and operating profit ahead of market expectations. Volex looks to have exited the year in a robust position supported by its diverse growth markets focus and strong customer relationships, built on recognised levels of service and reliability. In common with the broader sector, the group is seeing signs of supply chain normalisation, but still healthy underlying order positions, and reduced inflationary cost pressures. Net debt has fallen $22m in the second half of the financial year taking the covenant leverage to just 1x. Coupled with this, the share price fall in late 2021 and 2022 has meant that on most valuation measures Volex looks attractive with the shares now trading at a c.18 month low.

On the negative side boohoo was down 43%**, this reversed the strong gains from the first quarter, when the company was the strongest performer. This was driven by the news they have moved to a full-year pre-tax loss. The online retailer reported a loss of £90.7m in the year to 28 February 2023 compared to a profit of £7.8m last year. Sales also fell by 11% to £1.7bn, although revenue was 43% greater than in 2020, the last pre-pandemic reporting year. Margins slipped by 1.9%, reflecting Covid-related pressures on raw materials and freight, as well as its stock clearance.

In summary, it was a tough quarter for AIM companies with the majority of share prices falling in value. However, it was another quarter of outperformance vs the AIM index. Please remember that the AIM portfolio has been created to invest in companies that qualify for Business Property Relief (BPR) and in doing so are therefore outside of the estate for Inheritance Tax Purposes (IHT)***. Whilst delivering long term performance is obviously welcome, we are looking to mitigate share price weakness that would negate the reason for investing in AIM (saving 40% IHT).

* Source: MorningStar Direct

** Source: Alpha Terminal

*** based on current tax legislation and holding the assets for a minimum qualification period

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.