Market backdrop improving and share

prices bouncing back from depressed levels

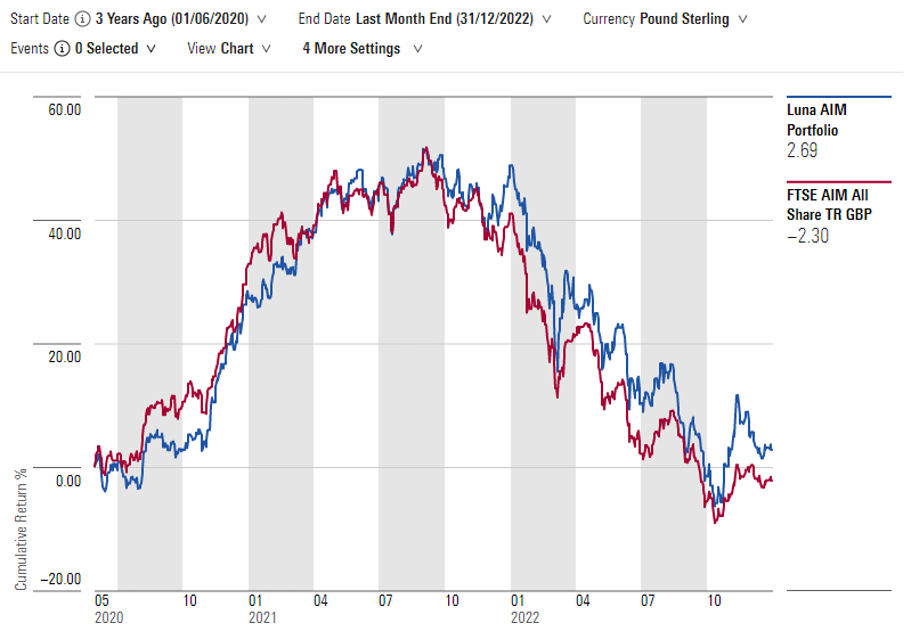

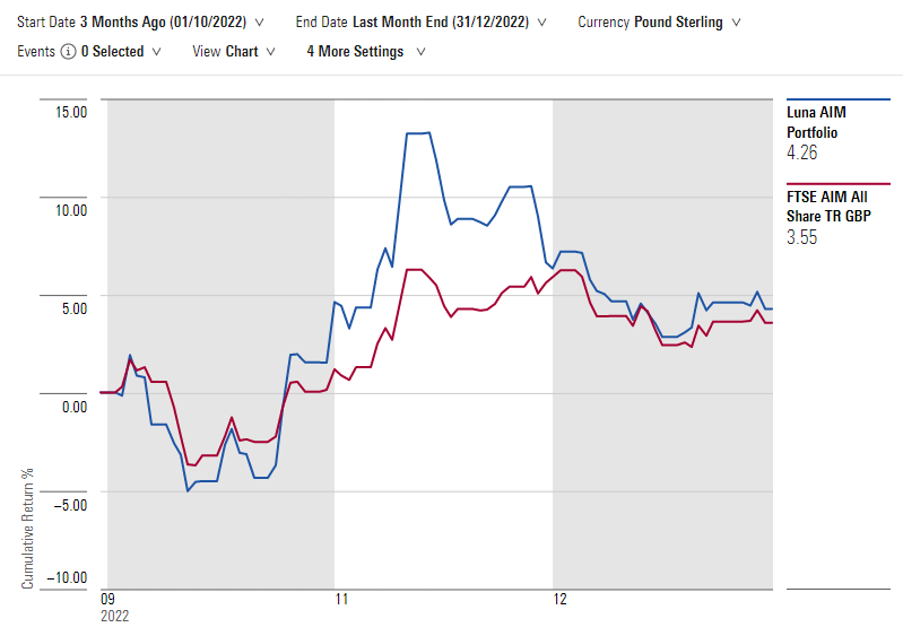

The Luna AIM portfolio delivered a return of 4.51%* during the first quarter which was significantly ahead of the FTSE AIM All Share TR index of -2.38%*. We are conscious that this is a very short-term time period and when taking a slightly longer-term perspective from launch (01/06/2020 to 31/03/2023) the Luna AIM Portfolio has outperformed, returning 7.32%* compared with the FTSE AIM All Share TR of -4.63%*.

During the quarter the standout positive performer was boohoo, which surged 67.9%**. There has been no spectacular news coming from the company during the period, but the large total return in a short period reflects how far the stock has fallen over the last few years and depressed the share price has been. The stock has received a number of broker upgrades, which is reflection that the general economic backdrop has improved. We continue to believe in the company over the longer-term and are comforted by the strong balance sheet.

It is also worth noting there were significant gains from a number of other holdings, where Jet2 continued to deliver strong share price returns (+36.9%**) following being the best performing holding in Q4-2022 and both Johnson Service Group and Breedon were also strong with a total return of 26.3%** and 25.4%** during the quarter. Breedon has also announced it is moving from AIM to a main market listing and will therefore be removed from the AIM portfolio in the coming months, as it will no longer qualify for Business Property Relief.

On the negative side Frontier Developments was down 51.2%**. The company creates video games, with some of their titles being F1 Manager (launched in August 2022), Jurassic World, Planet Zoo and Warhammer (to be released in May 24). As the company announced in the period, they no longer expect to meet market consensus forecasts for revenue and operating profit, which stand at £135 million and £19 million, respectively. Sales across its portfolio were subdued during the key festive period. Frontier also noted an “uncertain contribution” from its Frontier Foundry arm, which publishes games developed by partner studios.

In summary, it was a better absolute and relative quarter for the Luna AIM portfolio with the market backdrop improving and share prices bouncing back from depressed levels. Please remember that the AIM portfolio has been created to invest in companies that qualify for Business Property Relief (BPR) and in doing so are therefore outside of the estate for Inheritance Tax Purposes (IHT)***. Whilst delivering long term performance is obviously welcome, we are looking to mitigate share price weakness that would negate the reason for investing in AIM (saving 40% IHT).

* Source: MorningStar Direct

** Source: Alpha Terminal

*** based on current tax legislation and holding the assets for a minimum qualification period

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.