Liberation Day Update, Next Stop

4th July 2025

Sentiment in bond and equity markets has improved modestly in the last fortnight after it became clear that President Trump is open to negotiations regarding the imposition of tariffs on US trading partners.

The White House Press Secretary on 11th April also made it clear that the President is ‘optimistic’ an agreement can be reached with China. Finally, President Trump told reporters on 22nd April regarding his view on Fed Chair Powell that ‘no, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates”. Source: Bloomberg

All this has marked a shift after the aggressive approach to the original announcements – with Treasury Secretary Bessent appearing to exert his influence and market experience over policy hawks in the administration. Bessent is a former hedge fund acolyte of George Soros and Stan Druckenmiller, two of the most successful investment managers of modern times. He was also adjunct Professor of Economic History at Yale University.

Market Movements

Sensational headlines attribute falls in markets to the tariff policy; experience tells us that it is more complex than that. Market structure has changed significantly in the 25 years of our careers.

For example, focus has been on the rise in the yield on the US ten-year treasury bond. The rise, say commentators, is conclusive that

- tariffs are inflationary

- overseas investors are selling their holdings of bonds and

- the US Government will not be able to fund its obligations.

We can provide a detailed explanation as to why market structure contributed to the moves but note here that the narrative is not borne out in the data as yet. (Ned Davis Research 21st April 2025; Are foreign investors buying or selling US Debt?)

Despite the rise in the US ten-year rate during April from 4% to 4.38%, the yield is below the January 2025 high of 4.8%. Further, we do not believe it would be sensible for China or Japan to be selling their US treasury bonds wholesale. Doing so would cause their currencies to appreciate by selling dollar assets, whereas the Chinese in particular would like to see the yuan depreciate. The Japanese yen has already fallen significantly in recent years, bringing about a boom in inbound tourism. We do acknowledge that the rise in yields likely reflects greater political risk being priced into dollar assets, a changing perspective the world has on the US perhaps. This would also be a reason for the rise in gold.

Moving Forward

We are not complacent and acknowledge that the process of negotiating bespoke trade deals with 75 countries in a three-month period will be difficult. The prize of access to the US domestic market is a large one.

That said, we do take Secretary Bessent’s comments on rebalancing the US economy seriously – they are resolute about the administration’s trade, tax, and deregulation policy. These are designed to address the imbalances in the US economy (and perhaps also the stock market) that may take time to rectify.

The US stock market is dominated by several very large companies which have been behind a good period for Wall Street. We have been concerned about this level of concentration and high valuation in the US market overall, which has been reflected in our portfolio positioning. We believe there may be risks in a fully benchmarked, passive approach in the future as a result.

We are alive to the possibility that (in time) the tariff, tax cut and deregulation policies could have a positive impact on the smaller and medium sized part of the stock market. This may coincide with a more sluggish period for the largest companies and create a headwind at the index level for the S&P 500 (but bring benefits to those with a more active approach to stock selection).

All told, there is a shift in US economic policy underway. Such a change also happened under the Reagan administration – the history books tell us at that time anger towards Reagan and his policies hindered people from seeing that the policies would ultimately improve the economy.

So, what of the US Equity market?

We believe it is meaningful in the short term, at least, that US markets have bounced off the levels of the 2022 highs as shown on the following charts;

This suggests to us that equity markets are in a bottoming process but note that such a process can take some weeks. We take further comfort from the fall in the volatility index from elevated levels but it is perhaps early to suggest that prospects for a lasting rebound are firmly in place.

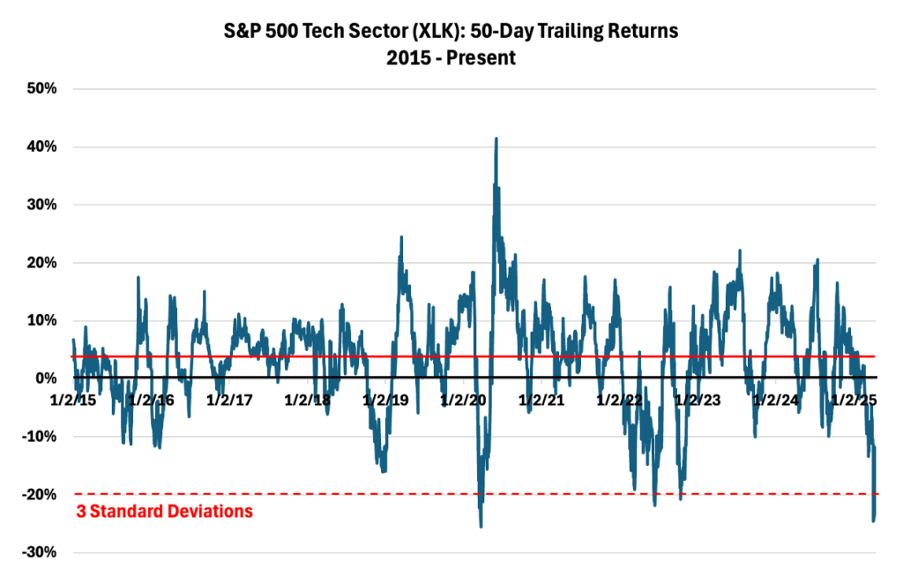

Additionally, when we view the recent market move in US tech stocks in the chart below, we can see that the fall has been extreme and the data suggests that investors could reasonably expect a bounce to occur sooner rather than later.

A three-standard deviation from the long-run average is a very significant move that has resulted in a recovery in the past.

The PORTFOLIOS

Changing constituents of portfolios during extreme movements is challenging owing to the large price swings, however we want to be clear that areas of portfolios continue to work even during this volatile period:

- Gold has continued to serve as an effective hedge amid ongoing trade uncertainty. It has made strong gains and reached our initial target level at $3,400 from where it would be reasonable to consolidate its recent performance. We see further upside potential from investment demand, ongoing central bank diversification and a reshaping of the financial system over the medium term.

- Structured products provide conditional downside protection at maturity but also the prospect of predefined annual coupons. We have had several successful investments mature over recent months and we are replacing these with protection levels lower down and higher potential annual coupons (typically 8%-9.5% per annum). On account of the time value of the options, these benefits do not immediately begin to accrue to the portfolio in the short term.

- Uncertainty creates demand for shorter dated government debt which offer attractive low risk annual returns of 4.5% to 5%. Again, these accrue incrementally over the course of any given year. High yield fixed income is also offering double digit annual coupons following recent weakness.

- Long/Short Equity Funds – we employ funds that aim to generate a positive return through hedging of general equity market risk or specific stock risk – our Tellworth UK Select Fund is up 1.7% in 2025 (to 17th April 2025)

- Features of equity investing – several of our active fund managers have a focus on non-index, attractively valued companies in sectors including banks, energy and telecoms. These companies tend to generate above-average cashflows which are returned to investors via dividends and share buybacks. Further, those companies with pricing power that are underpinned by brands, networks or critical products allow companies to pass on input costs to customers. The recurring revenues of many such companies should also protect in any economic slowdown. These features tend to be rewarded when the initial bout of fear subsides.

- Seeking out beaten down stocks – such indiscriminate moves in markets provide opportunities for exploiting over-sold conditions in stocks, sectors and individual markets, with various companies with good longer-term prospects trading at more attractive valuations.

Contact Us

If you would like to discuss any aspect of this update or your investments, please get in touch on 0161 518 3500 or email a member of the Luna team.

This publication provides general information only and does not address individual needs. Articles are not advice and should not be fully relied upon. While efforts are made to ensure accuracy, information may become outdated. Seek professional advice before acting. We are not responsible for any resulting loss. Tax laws, rates, and reliefs may change, and their impact depends on individual circumstances. Investments can fluctuate, and past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396