Stick to the Path

Much has been written about the market movements of the last week as journalists and market commentators try to establish the reasons for the market panic. For what it is worth, we believe that as much had been written about the US stock market’s historical performance in the run up to the first interest rate cut (the market usually does well), traders had one hand on the ‘sell’ button.

Thus, when the Federal Reserve all but confirmed last week that a cut is coming in September, investors acted, ‘better to travel than to arrive,’ as the old stock market saying goes.

That this coincided with a rate rise from the Bank of Japan, further widening future interest rate differentials between the Japanese yen and the US dollar after a lengthy period of yen weakness, added to the moves.

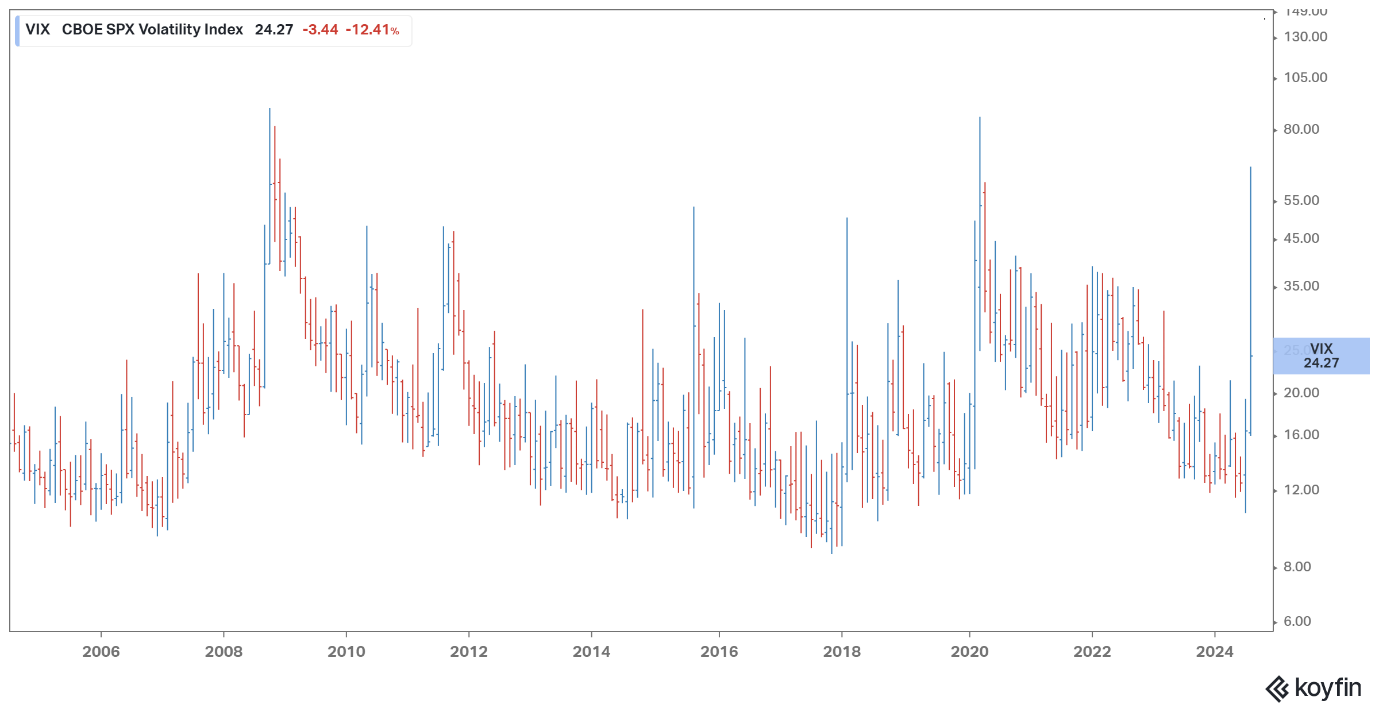

The chart shows the large and rapid rise in volatility, close to the Covid panic and the 2008 Lehman bankruptcy. We believe volatility is unlikely to go higher from here.

Market panic has calmed in the last couple of days, suggesting the most leveraged positions have been flushed out. We (and Ned Davis Research with whom we have worked since 2020) do not believe the moves are in the short term being driven by economic fundamentals. Pullbacks in an uptrend are normal but it is unhelpful that they are accompanied by a cacophony of dire predictions.

Further, several areas of the market have performed very well over the last year, like US Technology and Japan. This meant in the short term, a pullback was likely and healthy from a longer-term perspective. Luna portfolios remain diversified across different regions and sectors.

During Summer months, light trading volume can lead to exaggerations of market moves in both directions. Whilst the Japanese market was down 15% on Monday, it ended up 10% on Tuesday.

When reflecting on the events of the last week we consider that 75% of the S&P 500 has reported Q2 earnings; corporate profits are likely to grow by 11% in Q2 compared to 2023, fiscal spending (discussed in ‘Luna Perspective May 2024) remains robust and current economic data does not indicate an imminent US recession.

Ned Davis Research commented earlier this week ‘The bottom line of our indicators and models is that we’ve been seeing a global sell off that has left the market oversold with excessive pessimism, as our macro indicators haven’t been supporting the recession worries that have weighed down equities…..once the current sell-off runs its course, the global uptrend should resume.’ Tim Hayes, Chief Global Investment Strategist Ned Davis Research 5th August 2024.

In the short term, markets have reached over-sold conditions and excessive short-term pessimism. Damage has clearly been done to the technical picture, so we believe it is reasonable to expect sideways ‘choppy’ stock market action over the coming weeks. Further, we are mindful of looming risks in the Middle East, but we remain positive on US economic growth and on US equities.

We are aware of the concerns that short term market moves can cause. However, we remain focussed on the medium to long term picture, which we believe remains intact. History has taught us that sell-offs like this can also provide opportunities to add at lower market levels.

Traders mentioned earlier should remind themselves of the historic data; interest rates cuts where a recession did not occur have been typically followed by good equity market returns over the following months.

Please let us know if you have any questions.

This publication provides general information only and does not address individual needs. Articles are not advice and should not be fully relied upon. While efforts are made to ensure accuracy, information may become outdated. Seek professional advice before acting. We are not responsible for any resulting loss. Tax laws, rates, and reliefs may change, and their impact depends on individual circumstances. Investments can fluctuate, and past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396