Are Markets Defying Gravity?

Equity markets have bounced back in May after falling in April, seemingly ignoring delays to a cut in interest rates, ongoing conflicts in Ukraine and the Middle East and wider challenges to the existing world order. As global equity markets rise to new highs, we discuss why we believe that additional gains lie ahead over the rest of the year.

Fiscal Stimulus, Economic Data, and Company Earnings

The Biden Administration has enacted three significant pieces of legislation since 2022 – the Infrastructure and Jobs Act, the Inflation Reduction Act, and the CHIPS Act. These are measures designed to reshore and strengthen domestic manufacturing capabilities and accelerate the energy transition in the USA.

The size of fiscal stimulus is substantial, and we believe it is misunderstood that much of the investment is still to come, with the majority occurring in 2025-2027 (but will continue to 2030). Combined investment of $237bn representing almost 40% of the total stimulus is set to take place between these dates.

Given the positive impact on US economic growth we see limited scope for these measures to be reversed under a second term for Trump, although conditions for accessing the capital could be altered.

Data provided by Ned Davis Research (NDR), our key US based research provider that we have worked within since 2020, point to an expansion in the global composite purchasing managers index. The index measures both manufacturing and services sectors with the latest reading at the end of April 2024 of 52.41. Readings over 50 indicate economic expansion and coincide with a fall in NDR’s recession probability model.

The Federal Reserve also increased their GDP forecasts. Real GDP is forecast to be 4.2% in Q2, more than double the 1.8% rise in Q1. The average earnings growth for the S&P 500 in Q1 reporting season was 6.3% which compares to consensus analysts forecast of 1.1%. This growth in earnings has been accompanied by an increase in share buybacks and dividend announcements, reversing the decline from 22/23. Apple notably announced the largest buyback in history, but this was accompanied across a wide variety of sectors.

All told, this suggests increased corporate confidence following the reorganisation and strengthening of corporate balance sheets that took place during the pandemic. Economic growth and indicators are also accelerating in the UK and Europe, with corporate earnings coming in stronger than expected.

Stock Market Behaviour

It is no surprise that this improving economic performance has been accompanied by rising stock markets. The gains in US equity markets in the last quarter of 2023 were driven by three sectors; technology, industrials, and gains in US equity markets in the last quarter of 2023 were driven by three sectors; technology, industrials, and financials, with the technology sector being the most important sector in terms of weighting within the index.

It is notable, and very positive, that the recent advance has not been concentrated solely in the technology sector – we have seen a broadening in sector participation, with utilities, energy, industrials, and financials all posting good returns so far in 2024. The financial sector is likely to be a beneficiary from the ‘normalised’ rate environment whereas the other three benefit from Biden’s legislation.

Global Markets in 2024

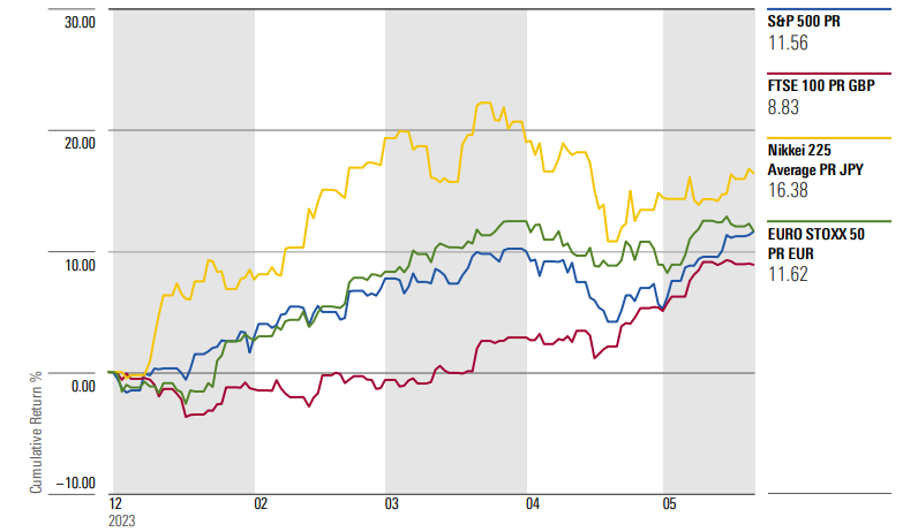

Furthermore, when we look outside of the US we are seeing broad based strength across global stock markets. New all-time highs have been recorded in the UK, across Europe as well as investor behaviour. We see a bullish trend being confirmed by new highs in the S&P 500 crossing 5,300 and other global indices.

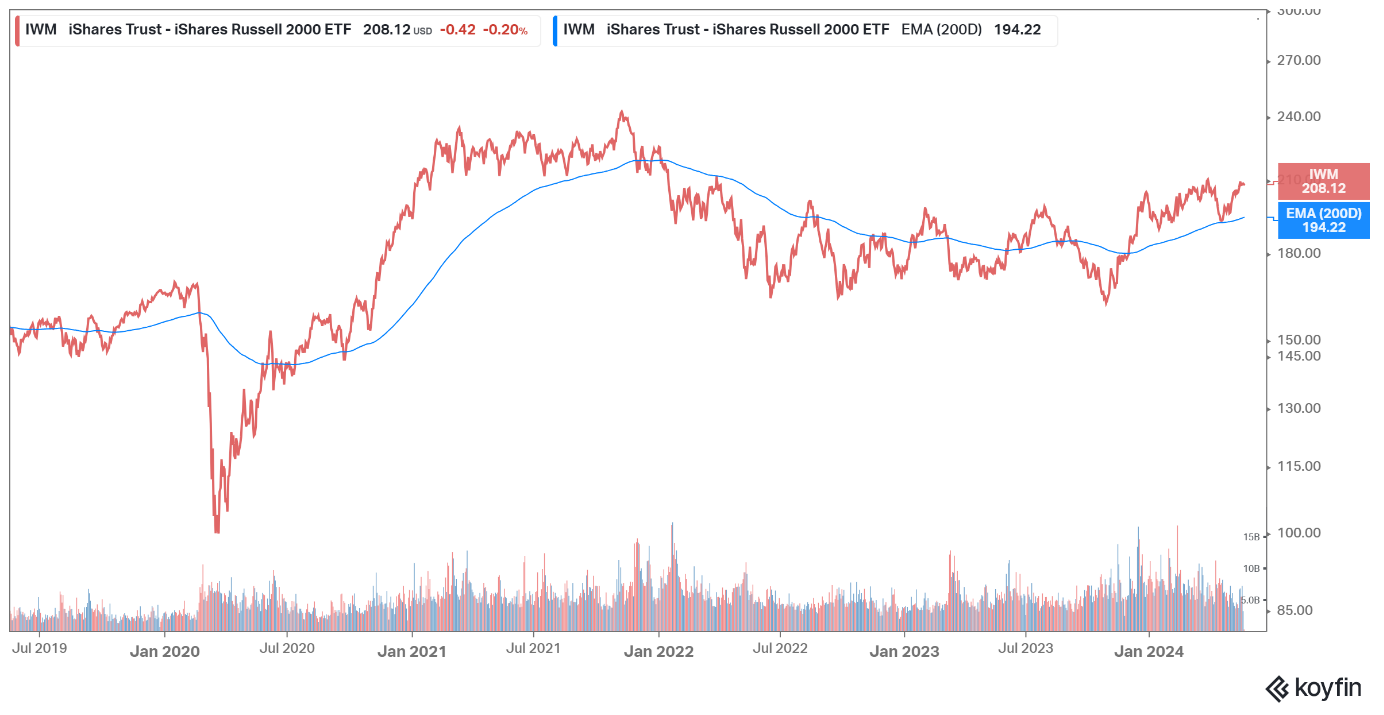

However, we note that there are parts of global stock markets that are not trading at all time highs, notably smaller capitalised stocks that have historically been positive correlated to improving economic data. This is true of US small cap as well as smaller companies in the UK, Europe, Japan, and Asia. The commonality in the stock market behaviour suggests that new highs may also lie ahead for small cap stocks.

Ongoing Rapid Pace of Technology

The impact of artificial intelligence (AI) is unknown but likely a positive influence on economic productivity over time. In the first instance, we have seen significant positive impact on the earnings of companies across semi-conductors and cloud operators. The advent of AI and the speed of its introduction we believe is a positive for the stock market’s earnings outlook in aggregate.

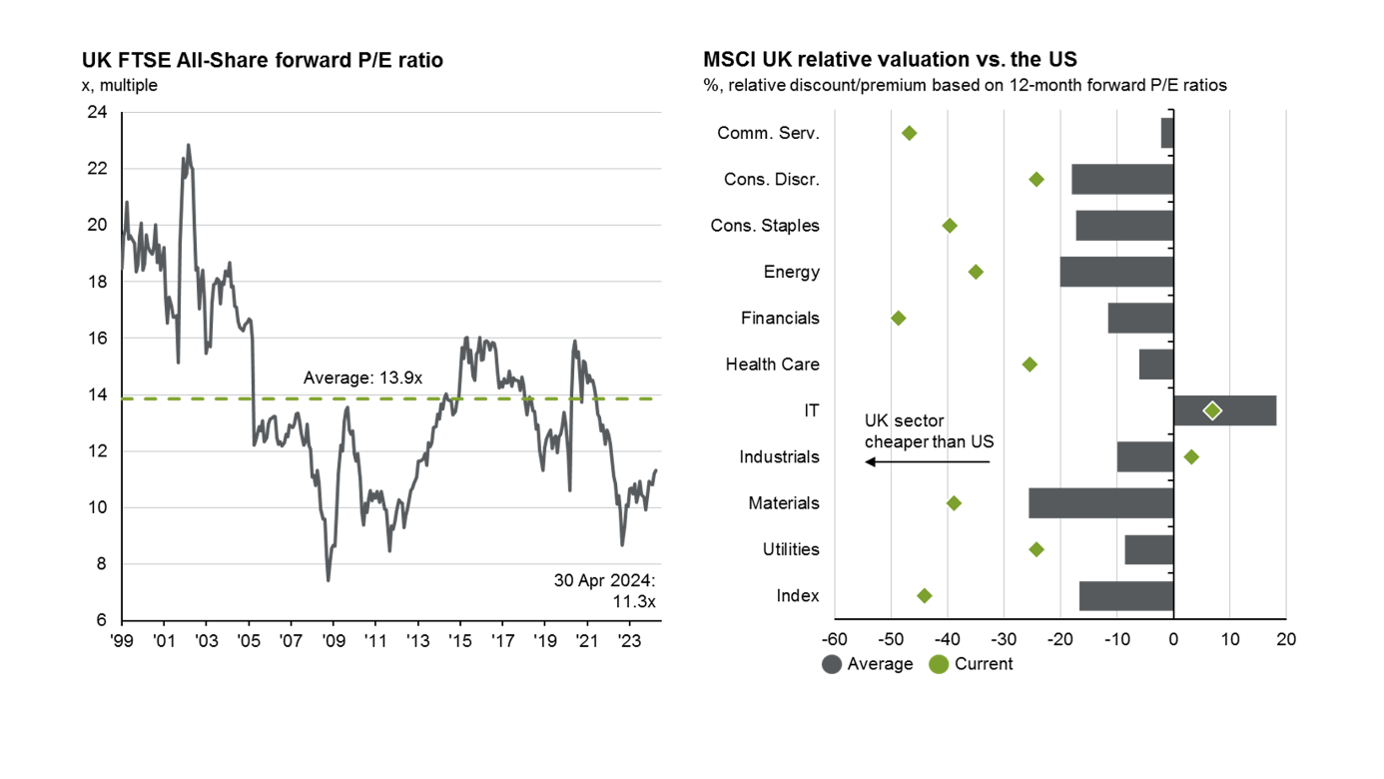

A Word on the UK

We have written before on the relative attractiveness of the UK equity market. Despite the rise to new all-time highs, valuations today remain historically low in absolute terms.

We note a distinct change in the discussion, with the low ownership of UK Equities amongst UK Pension funds receiving particular focus. This leaves UK companies vulnerable to takeovers which have increased in volume during 2024 so far; the recent bid for Anglo American from BHP has raised the profile of the UK stock market amongst international investors. All this gives us confidence that further gains lie ahead for the UK stock market as it catches up on recent underperformance and closes the valuation gap with developed markets more broadly.

Inflation

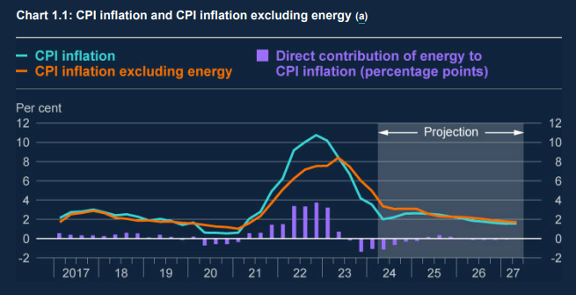

Central banks around the world are proving cautious in their approach to reducing interest rates. In the May inflation report, the Bank of England produced the following projections which we anticipate will have a further beneficial effect on investor sentiment towards UK assets..

What to Watch Out For

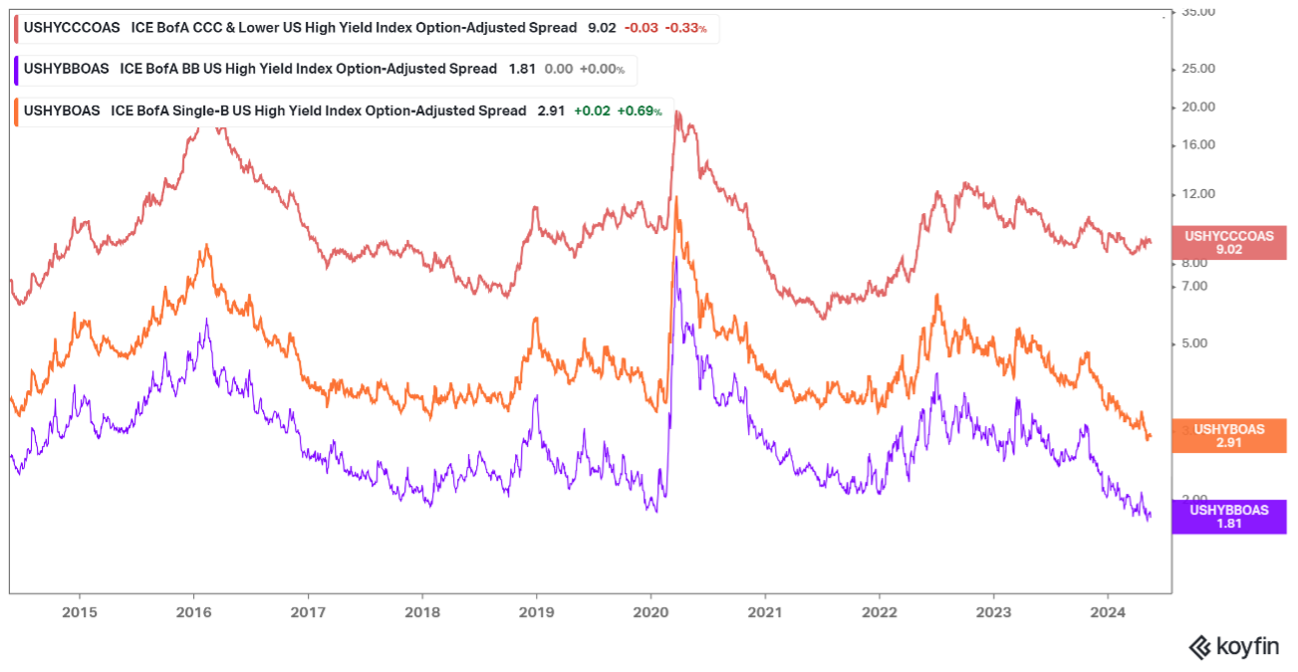

Historically, weakness in indicators such as the spread (the extra return received) of high yield over government bonds and rising volatility have been indicators of potential stock market weakness.

Currently, the spreads trade at low levels as indicated by the following chart shows the spreads on B, BB and CCC bonds which indicate a lack of stress within the credit markets.

The Volatility Index (VIX) has recently fallen below 12, signalling falling anxiety amongst investors. Stock market data shows that there have been 14 occasions over the last twenty years when this has occurred – the S&P 500 was higher on average by 9.5% a year later, bar one occasion in 2007.

We believe our view that further gains lie ahead for equity investors over time is supported by both falling bond yields and recession risks, rising earnings and company confidence.

Conversely, this ongoing improvement in the environment would be threatened by a reversal in bond yields as they moved higher (perhaps signalling a return of inflation), an increase in recession risk and a slow down in expectations for earnings in expectations for earnings growth. Any reversal in these conditions could occur gradually as part of the economic cycle or from ‘knock on’ effects from any deteriorating geopolitical situation.

This publication provides general information only and does not address individual needs. Articles are not advice and should not be fully relied upon. While efforts are made to ensure accuracy, information may become outdated. Seek professional advice before acting. We are not responsible for any resulting loss. Tax laws, rates, and reliefs may change, and their impact depends on individual circumstances. Investments can fluctuate, and past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396