The US Election

The votes are nearly all in, the American people have spoken, and Donald Trump has been confirmed as the 47th United States President. The Republican party has also taken the Senate but the outcome for the party winning the House of Representatives is a doubt at this stage. This is important because it will help/hinder any progress in terms of passing future legislation. We thought it would be helpful to provide a summary of our view.

Whilst the new President will not take office until January 2025, markets will seek to distil potential future policy on immigration, tariffs, foreign policy and fiscal stimulus. The potential impact is not known at this moment in time, but even in the event of a ‘Red Sweep’, we note that new legislation around tax cuts and fiscal policy will not take effect until 2026. (Please see Luna Perspective: ‘Are Markets Defying Gravity’ for the hitherto size of fiscal stimulus planned 2025-2027).

One thing we have always said is that markets like certainty. We now have that, and November usually marks a seasonally strong period for global stock markets, leading to the ‘Santa Rally’ (defined as the last trading week of December and the first two days of a new year).

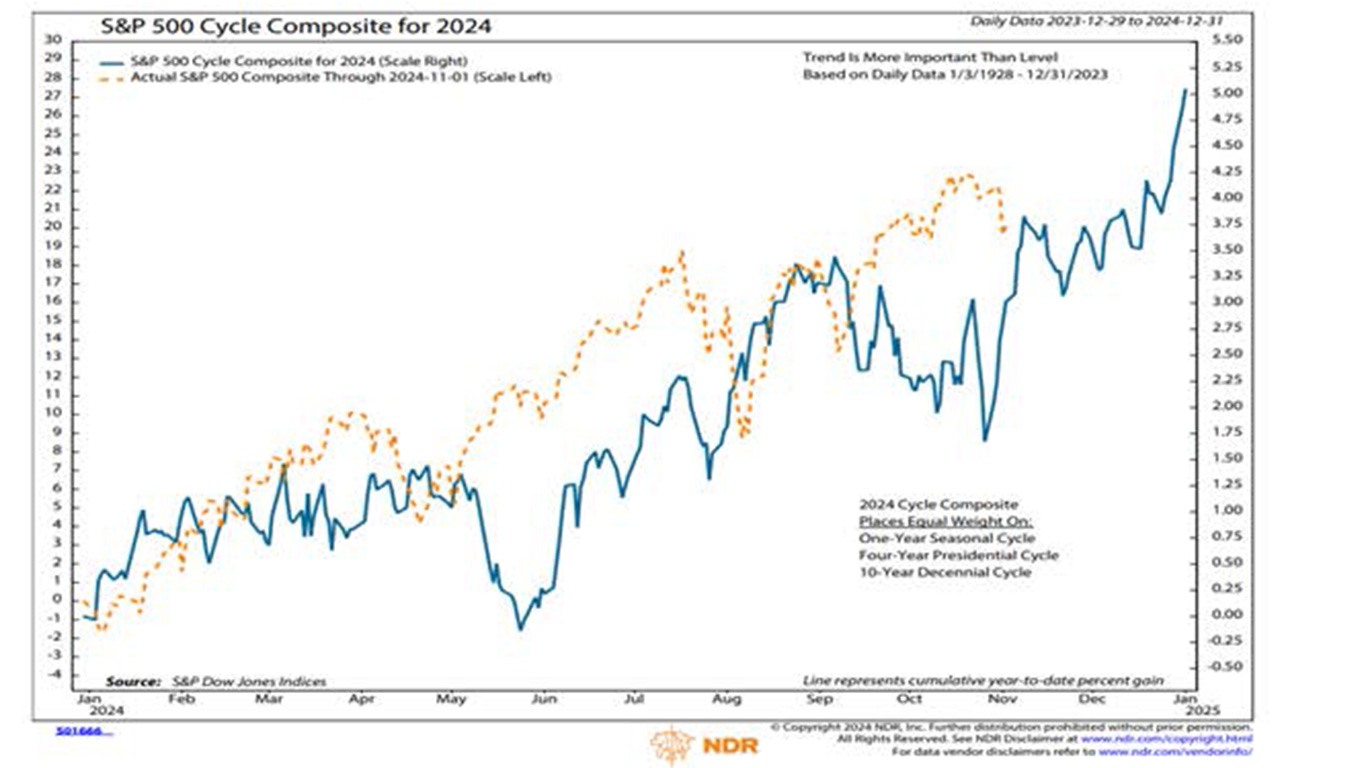

The chart below focusses on the NDR S&P 500 cycle composite (blue line) vs how the market has panned out this year (S&P 500 is the dotted orange line). It would be of interest if markets were not to follow these trends.

The initial market reaction in the US to the result has been very positive with stock markets across many parts of the globe bouncing. The tech-heavy Nasdaq 100 and S&P 500 closed up 2.9% and 2.5%, respectively. The Dow Jones Industrial Average closed up 3.5% and Russell 2000 (smaller companies) up 5.8% on the heels of a winning day for stocks. Interestingly, the Hang Seng, the Hong Kong stock market, was lower by over 2%.

Global bond markets are steady this morning, but government bond yields have been increasing (bond prices falling) over the last few months and potentially pricing in a Trump victory. The US dollar has also strengthened as interest rates are likely to be higher longer term. We would not normally comment on Bitcoin, because UK investment managers are not authorised to invest into cryptocurrency under current FCA rules, but that is up 7%. We note that the technology sector did well under the previous Trump administration.

Some of the key points of policy to be considered.

- Trump’s overall fiscal packages are higher than Harris’. The US already has a huge fiscal deficit, and this looks set to increase with Trump being elected President. Gold has been rising recently and Treasuries have been under pressure – this trend could continue (some of this has been priced in though).

- One of the key reasons the deficit is due to blow out is because Trump has proposed cuts to Corporation Tax, which should be a positive for US equities because it improves profitability. Ned Davis Research in their presentation ‘Risks and Opportunities for US Markets’ 4th November 2024 suggested that Trump’s proposed corporation tax rate would increase after tax income for the S&P 500 by 4.7% vs a reduction of 8.6% under Harris.

- Before the election, Ned Davis Research indicated that as US or Global recession was not imminent and a Trump victory in our view confirms this looks more unlikely. The below chart highlights several indicators about the probability of a recession, as you can see 0 out of the 11 are flashing as warning signs at the moment. Again, this a positive for stock markets.

Global recession risk remains low.

- A Trump win should favour domestic earners including Small Caps, Financials, Utilities, Communication Services, not just at the large cap level. Several of the funds we invest in this space are orientated this way; Harris US Value and Findlay Park American are positively positioned we feel.

- Pershing Square Holdings which had a difficult summer has holdings in Freddie Mac and Fannie Mae. The mortgage companies entered conservatorship during the financial crisis. The value of the equity in these firms has increased significantly since 2008, and the new administration may well look to realise this value as it increases fiscal expenditure, benefitting Pershing Square’s net asset value. Pershing’s share price has risen strongly today.

- He has also been very vocal about increasing tariffs; 10% on the rest of the world and 60% on China. We’ve seen this before, this policy stance and interest rates increasing in the US were key reasons why global stock markets were weak in 2018. This risk of another similar impact on markets has certainly increased.

- As well as this, Tariffs have the potential to be inflationary and it is difficult at this stage to know exactly what will materialise. Previous rounds of World Trade Organisation negotiations have seen China, India and Brazil refuse to lower certain tariff rates and Trump’s stance may well be designed to level the playing field for the USA, rather than the start of an aggressive trade war. Importantly though, trade has not been damaged from the tariffs previously amended and kept in place by Joe Biden.

- What does this mean for the Federal Reserve? They are meeting on the 6th and 7th November with the announcement on the evening of the 7th. In the short term, we are still expecting an interest rate cut at the meeting in November and maybe December. However, Trump’s policies tariffs/tax cuts do have the potential to be more inflationary, so longer term this might keep US interest rates higher for longer.

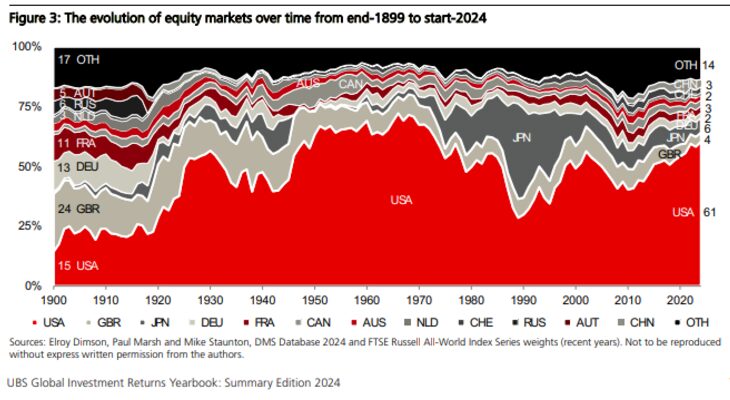

The election result comes at a time when the US stock market has performed strongly and valuations for part of the market are above average. The concentration of the stock market has also increased.

The election result comes at a time when the US stock market has performed strongly and valuations for part of the market are above average. The concentration of the stock market has also increased.

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396