A global geopolitical risk that has been weighing

on investors’ minds for a number of months

On Monday (21st February 2022) evening it was announced that Russian troops were deploying into Donetsk and Lugansk in eastern Ukraine. Russian forces have now launched a military assault on neighbouring Ukraine, crossing its borders and bombing military targets near big cities. This is clearly a fast-moving situation, the news wires will be hot going forward and as we sit here today there are still a number of unknowns.

This has been a global geopolitical risk that has been weighing on investors’ minds for a number of months and whilst markets have been weak recently, the run up to the event can have a bigger impact than during the event itself. This is because stock markets move in anticipation of events and it is the beforehand uncertainty that has the negative impact.

We believe this is one of several drivers to market performance in 2022. Investors have been concerned the Federal Reserve are ‘behind the curve’ on inflation and therefore interest rates look likely to move higher than previously anticipated.

It is also important to remember that we have seen a significant recovery in economies and stock markets over the last two years. The S&P 500 has borne the brunt of profit taking in 2022.

How have markets been impacted in recent weeks;

- The Oil and Natural Gas prices have both increased. Russia is a larger producer of both commodities and any uncertainty will push prices higher.

- Safe haven assets like Gold and Government Bonds have steadied.

- Most stock markets are lower.

Past geopolitical events and the subsequent US stock market moves

That feeling of déjà vu? We have been here before… Russia invaded the Crimean Peninsula on the 20th February 2014 almost 8 years ago to the day. Stock markets were weak in January 2014 before the event… but recovered in February 2014.

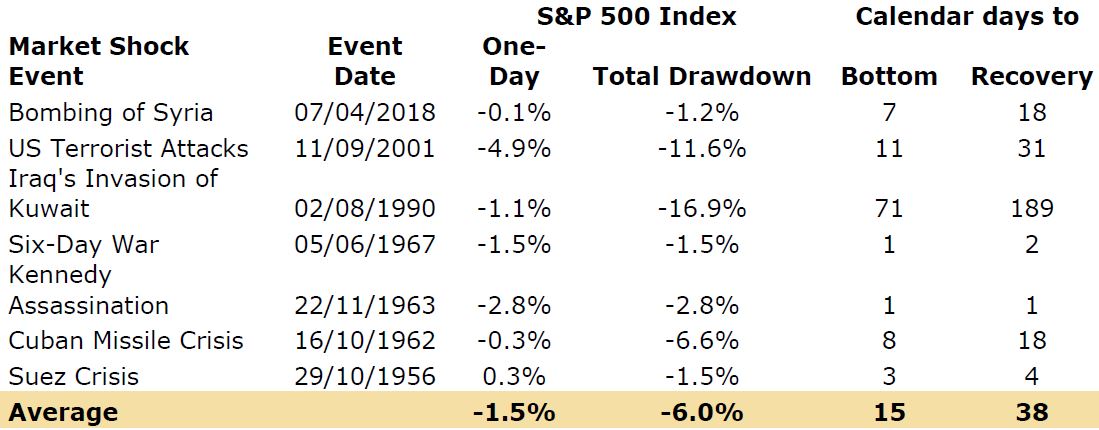

The following table shows the average initial daily market fall in the S&P 500 during a geopolitical event was 1.5% and the total drawdown from peak to trough is 6%. It can take roughly 15 days to the stock market bottom and they have historically recovered in just over one month. We hope this provides some comfort that investing during these times can be uncomfortable for a day or a couple of weeks but markets have historically recovered quickly on average.

Thinking Longer Term

So far, we have focussed purely on the short-term impact on markets. Our focus is always on taking the longer term view, particularly during times like we are going through at the moment. We do this because it stops us getting dragged into the short-term nervousness of investing, stay rationale and most importantly it matches investors own investment time horizons.

The table overleaf focusses solely on capital market performance in times of war. In 2015, researchers at the Swiss Finance Institute looked at US military conflicts after World War II and found that in cases when there is a pre-war phase, an increase in the war likelihood tends to decrease stock prices, but the ultimate outbreak of a war increases them. However, in cases when a war starts as a surprise, the outbreak of a war decreases stock prices. They called this phenomenon “the war puzzle” and said there is no clear explanation why stocks increase significantly once war breaks out.

Similarly, Mark Armbruster, the president of Armbruster Capital Management, studied the period from 1926 through July 2013 and found that stock market volatility was actually lower during periods of war. “Intuitively, one would expect

the uncertainty of the geopolitical environment to spill over into the stock market. However, that has not been the case, except during the Gulf War when volatility was roughly in line with the historical average,” he said.

Capital Market Performance During Times of War

Source: Mark Armbruster / CFA Institute

Capital Market Performance During Times of War

Government bond prices have been increasing over the last week because an increase in geopolitical risk is often a good environment for bond markets as investors look for safe havens. Looking forward this conflict has already led to the increase in commodity prices (Natural Gas and Oil). These pressures are not disappearing in the short term and the eye watering annual inflation rate looks firmly supported.

How do central Banks respond to this? It is important to remember Central banks have a dual mandate; price stability (inflation) and economic growth. Inflation is likely to stay elevated because of these developments which would lead you to expect further interest rate hikes. However, we feel this is unlikely because the nervousness this event has caused is more likely to feed into economic growth and therefore reduce the pace of interest rate hikes. We are also aware that with a US mid-term election coming later in the year the Federal Reserve will be looking to avoid increasing interest rates at that time because they could be accused of political interference. After a very strong selloff in government bonds, we now expect bond prices to steady.

As bonds steady, we believe this should provide a more supportive backdrop for the share prices of the growth orientated sectors, such as technology.

Luna positioning

Our overall asset allocation and the underlying are under constant review and as we entered 2022 we are comfortable with how Luna client portfolios are positioned.

Prior to this event, we already had negligible investment exposure in Russia and it is a very low asset allocation in most major bond and equity markets.

The movements in markets in 2022 has created opportunities in different areas of our investment universe, notably investment trusts and structured products. We are not however tempted to look at Russian focused vehicles that trade in London.

Our exposure to mining companies for example is purposefully in developed markets and we remain very optimistic on the outlook for the diversified miners and the UK listed oil companies.

UK stock market valuations remain very attractive versus global peers. We believe relative to government bond yields, the UK stock market remains attractive and that is responsible for the relative outperformance in 2022. Together with a recovery in the technology and growth sectors when sentiment improves we remain positive on the outlook for the rest of the year for UK investors.

The content in this publication is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Luna Investment Management Limited (FRN: 923454) is an appointed representative of Thornbridge Investment Management LLP (FRN: 713859) which is authorised and regulated by the Financial Conduct Authority. Luna Investment Management is registered in England. No 12280396